First, why does an agent partner with a new lender?

Success in the real estate industry is built on trusted relationships. Agents considering a new lender relationship do so for one reason – to close transactions faster by making sure the buyer will qualify for financing. So…how are you going to help your agents close deals faster? And, in the process, how are you going to get the best mortgage leads possible?

The best mortgage leads require strong agent relationships

According to Realtor Magazine, 74 percent of homebuyers consider the mortgage company referred by their agent. To increase the lenders’ chances of securing that new business, it makes sense to have mortgage information displayed in front of active home buyers instead of on other sites – which can potentially connect a homebuyer with a lender that doesn’t have a relationship with your top lenders.

Relationships are your foundation

Relationships are the foundation to generating more mortgage leads. Local real estate agents and brokers know that a successful transaction is predicated on having the right lender. The MLS can serve as the launching point for lenders to show their financing creativity by helping agents identify special financing opportunities. Being on the MLS listing is the first, best, and most convenient opportunity to establish trust with a homebuyer. Pre-qualification of properties listed within the MLS for special financing can dramatically change the affordability profile of a given property. This is another example of the power of MLS integration that helps the agent and the originator alike.

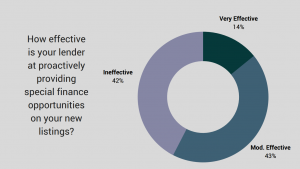

Agents want proactive research

Agents want proactive research

To help homebuyers better understand the true cost of the desired property, financing options must be made clear from the beginning. Real estate agents do not have immediate access to special financing options on their listings (VA, FHA, Assumable, Zero Down, and other First Time Homebuyer programs.) Research is time consuming and agents expect their lenders to proactively provide this research.

Protect your agents from the unknown – generate more mortgage leads

The best mortgage leads are qualified buyers. The National Borrower Satisfaction Index study revealed that trusted lenders improve homebuyer satisfaction – which improves the agent relationship with also improves mortgage lead volume. 31 percent of homebuyers that received significant direction from their agent reported a “very high” satisfaction rate of 95. The lessons are clear: “Good loan originators result in highly satisfied borrowers, who are also more likely to comment favorably on social media, thereby enhancing a lender’s reputation, which attracts more borrowers.”

That’s where RatePlug can help

RatePlug helps lenders protect high-value agent relationships. By connecting lenders with their trusted agents on more than 60 MLS networks, RatePlug redefines agent-lender cooperation on the MLS platform. With RatePlug, lenders connect with their agents. Agents then allow lenders to post their rates and products on their MLS listings. By connecting their most trusted lenders into their MLS listings, agents protect their buyers and ensure that the lenders that are most capable of “getting the deal done” are introduced early to homebuyers as they are searching for a home.

RatePlug also equips lenders with powerful research tools so that agents can quickly be informed when a property is eligible for special financing options.

MLS integration gives you the best mortgage leads

In 2016, RatePlug was used by 4.9 million homebuyers and displayed on more than 115 million property report views. More than 700,000 real estate agents have access to RatePlug from the MLS. With the broadest direct MLS integrated reach in the industry, RatePlug is far more than a interactive mortgage calculator, advertising app, or a flyer system – RatePlug helps lenders supercharge mortgage lead volume and close more loans by giving lenders greater access to their most trusted agents. Agents spend most of their time on the MLS because it is the most recent and accurate information available anywhere.

While the MLS is a solid collaboration and research tool for agents, without RatePlug, lenders have little access to the platform. As a result, mortgage lenders seldom understand the power the MLS can provide to mortgage lead generation. In fact, most lenders completely overlook it because it is, after all, for real estate agents. Home-buyers who intend to buy are using the MLS.

If you want to catch your lenders’ attention, show them the money.

For lenders to properly convey why an agent should do business with them, they need to show agents a clear path to closed transactions. Rate Plug’s integrated MLS technology helps lenders prove their value to trusted agents. Communicating that value starts by helping the agent accelerate deals. In fact, agents with RatePlug enabled on their listings report a 15% faster “contact to contract” rate. When you help the agent close faster, you build trust – which drives more mortgage leads – which creates more transaction volume.

When you add RatePlug’s interactive, property-specific financing calculator to an agent’s MLS listing, you instantly create more awareness for your business. In fact, in 2016, RatePlug subscribed originators averaged 23,000 MLS displays.

ADDITIONAL MORTGAGE LEAD RESOURCES