RatePlug gives homebuyers live, accurate mortgage payment information from your preferred lenders and also notifies the buyer if the property is eligible for special financing. This information helps to qualify more buyers and close deals faster. Showing rates from your lenders helps to ensure that buyers are getting financing from someone you trust.

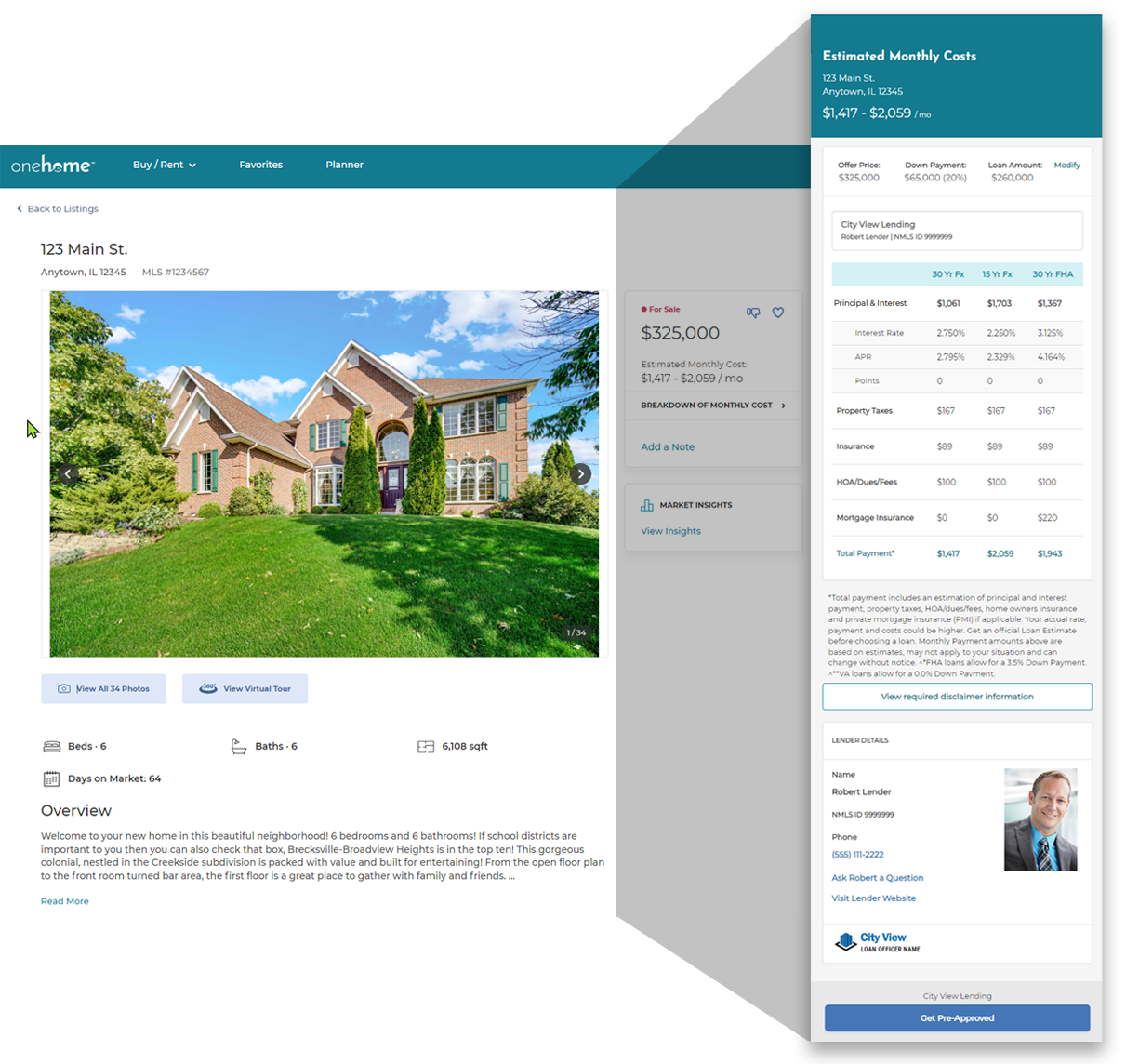

RatePlug Places Live Payment Calculators on Your LVR Listings

RatePlug's accurate monthly cost-to-own estimates are customized with rates and products from your trusted lenders. Your buyers will be able to see and interact with the payment information on every listing they view through OneHome. And there is no cost to you to activate RatePlug. It is already included with your LVR subscription. Simply activate RatePlug to get started.

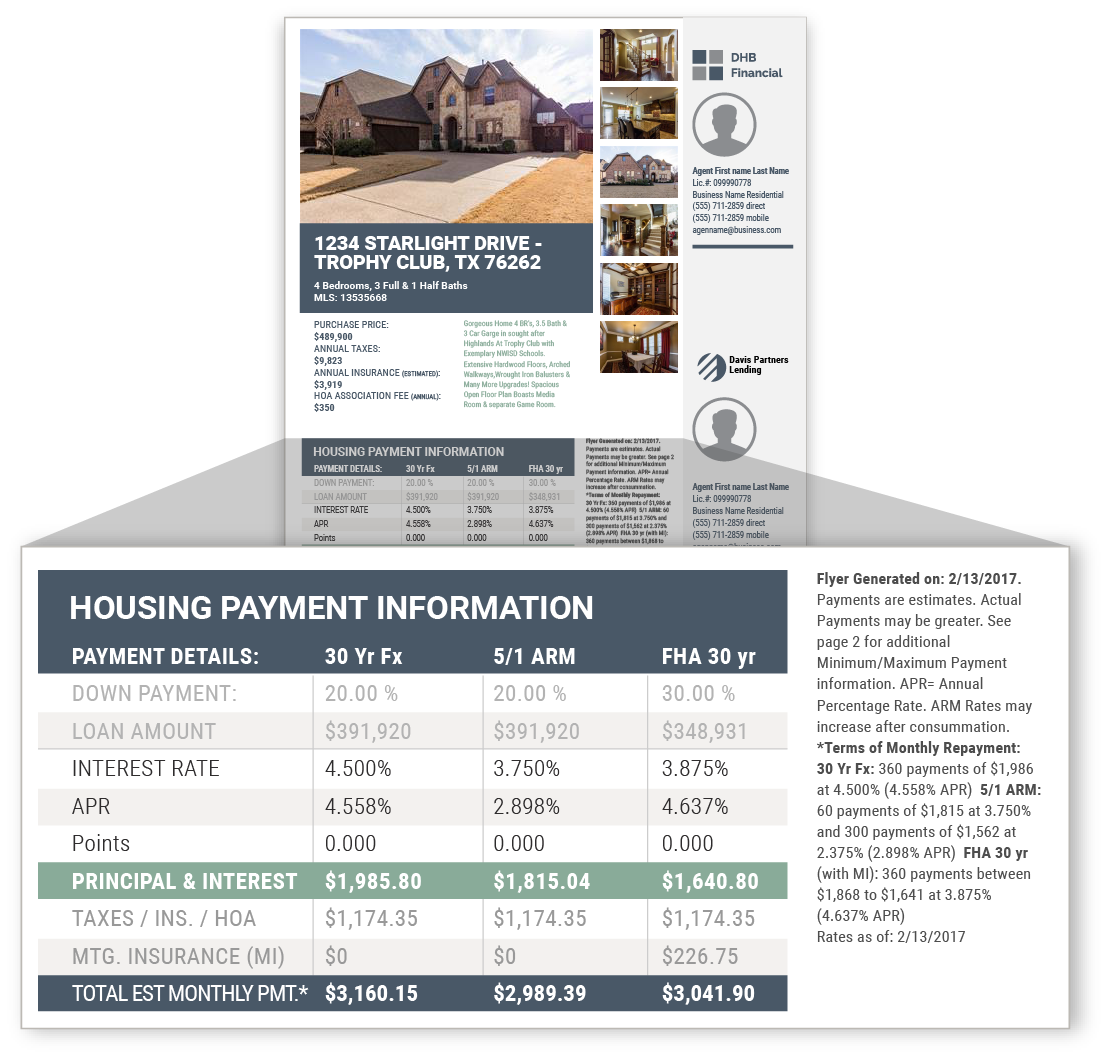

New Virtual Property Flyer Feature

Keep Vital Information Flowing to Buyers

The new Virtual Flyer is ideal for an Agent's virtual tours and open house events. This online tool keeps fresh property and payment information flowing to homebuyers. The listing Agent will automatically receive a link to the flyer which they can send to prospective buyers. Other features include:

- Easy Export to Social Media – Also SEO friendly link.

- Share with potential Buyers for Virtual, Streaming or in-person Open House

- Use with Showings to help buyers understands special finance options available.

- All information on the Flyer is dynamic and updated in Real-Time.

- Buyer can interact directly with Agent or Loan Officer.

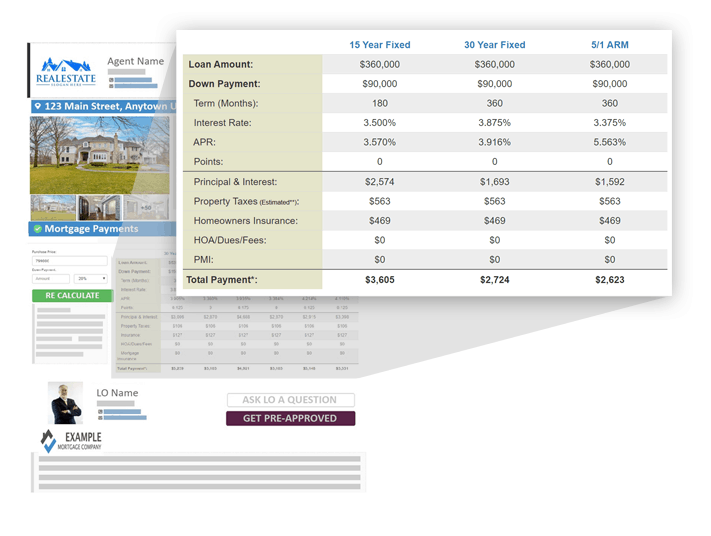

Custom Real Estate Flyers Included

When you list a new property on LVR, RatePlug also allows your loan officer to create custom flyers for your listing that include their mortgage information.

RatePlug Advantages

- Accurate costs and special financing options help you close sales faster

- No worries about sending buyers to lenders you don't know

- RatePlug payment calculator is automatically displayed in LVR

- Create custom flyers with estimated loan payments from your lenders

- All compliance handled by the RatePlug system

- There is no cost to you to activate or use RatePlug

*Loan Officers are required to pay a license fee to be displayed